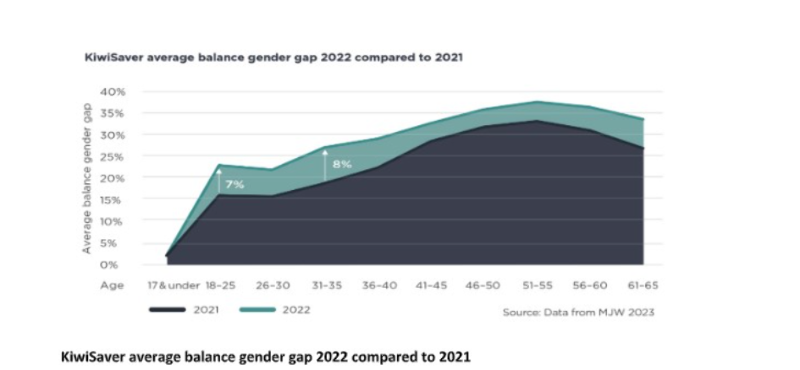

The gender gap for average KiwiSaver balances widened five per cent from 2021 to 2022, increasing from 20 to 25 per cent.

New data from the Te Ara Ahunga Ora Retirement Commission shows gender gaps in every age category widened with larger gaps opening in younger age groups, up 7% to 23% for 18-25 year olds and up 8% to 27% for 31-35 year olds.

Melville Jessup Weaver (MJW) actuaries was commissioned to collect KiwiSaver demographic data as at December 2022 to update data first collected as at December 2021.Data was gathered from more than three million KiwiSaver members and represents approximately 94% of the total KiwiSaver member base.

Te Ara Ahunga Ora Director, Policy and Research, Dr Suzy Morrissey says the research builds a picture of the challenges women face to grow their KiwiSaver balances.

“Analysis of the widening gap does not appear to be explained by fund choice, withdrawal, or suspension behaviour of women compared to men.”

She says the widening of the gap at younger ages is particularly concerning because of compounding interest.

“Money invested earlier will have time to grow, but if women’s balances are lower than men’s in younger life, they will likely remain lower,” says Dr Morrisey.

Analysis was also done to understand the impact of significant hardship withdrawals, first home purchase withdrawals, and savings suspensions using additional from Inland Revenue. Withdrawals and suspensions did not explain the differences – more men were on suspensions and had withdrawn more money. It was noted that data does not capture those who have left paid work and no longer contribute (not a savings suspension).

The report shows that the average KiwiSaver balance as at 31 December 2022 was $27,379, a drop of 5.7% from 2021, reflecting poor financial market conditions over the 2022 year. Balances dropped across all ages, and both genders were impacted.

For males, the average balance fell 3.2% (to $31,496).

For females, the average balance fell 7.1% (to $25,144).

More men in growth funds

The research has also investigated member balances across age and gender by fund type for the first time. It found that more than one third of all funds under management are assets invested in growth funds, this allocation decreases with age.

Men have more assets invested in growth funds, while women have more assets invested in conservative funds. This difference is smaller at younger ages and more pronounced for those nearing age 65, and over 65.

Analysis suggests that women are not necessarily more risk averse, as both men and women tend to be invested in lower risk funds if they have small balances and have more growth assets if they have larger balances. Women’s lower balances (on average) may lead them to be less risk-seeking.

The widest gaps of average balances are still between men and women in their 40s and 50s, which likely reflects the combined impact of the gender pay gap, time out of paid work, and the higher percentage of women than men that work part-time.

On average women in their 40s have approximately $10,000 (or 34%) less KiwiSaver than men; and on average women in their 50s have approximately $14,500 (or 37%) less KiwiSaver than men.

Other findings:

41% of KiwiSaver members have a balance of less than $10,000

- 60% of which are

- 35 and younger, a quarter of those over the age of 35 have balances under $10,000

- 1 in 5 of those aged 51–65 have less than $10,000.

38% of KiwiSaver funds are invested in growth funds

- for the under 50s, this is around half of investment balances, decreasing to 30% for those aged 50–65 and less than 20% of investment balances for those over 65.

Women have more assets invested in conservative portfolios, while men have more assets invested in growth portfolios.

- this difference is small at younger ages and more pronounced at older ages.

- this does not necessarily reflect different risk profiles; it could relate to balance size, as those with lower balances may be invested in lower risk funds.

The 2022 Review of Retirement Income Policy found that 40% of people aged 65 and over have virtually no other income besides NZ Super and another 20% only have that, and a little more.