Market movements saw KiwiSaver assets grow $8 billion in the last quarter of 2023, ending the year at $104 billion according to Morningstar’s latest data.

Average multisector category returns for the December quarter ranged from 4.9% for the conservative category to 7% for the aggressive category. Default options averaged 6.3%.

All KiwiSaver providers, with the exception of two, produced positive returns over the December quarter, with most north of 5%.

Of the default funds, Simplicity, which made a small fee cut (0.29 to 0.25%) this month, had the best return of the quarter at 6.8%; for the 12 month quarterly result it shared first place with KiwiWealth, both returning 13.7%.

Morningstar analyst Greg Bunkall says Quay Street continued to perform well across many time periods in the conservative and balanced categories.

Milford had consistently high performance within the moderate, balanced, and growth categories over the long term, though it struggled in 2023 coming in at 17th, 22nd and 11th place across the three categories.

At the outer margins, the highest performer for the quarter (47.9%) and for the 12 months (149.3%) was Kōura’s Carbon Neutral Cryptocurrency fund, although at $2.7m in assets its impact on the market is negligible.

The lowest quarterly return of -7.2% was from Kernel’s S+P Kensho Electric Vehicle Innovation fund ($0.3m), and proving that it was not a good year for clean energy stocks, Kernel’s S&P Global Clean Energy fund ($0.7m) had the lowest 12 month quarterly performance at -14.9%.

Over 10 years, the aggressive category average has given investors an annualised return of 8.3%, followed by growth (7.9%), balanced (6.4%), moderate (4.6%), and conservative (4.3%).

Marketshare

KiwiSaver assets in the Morningstar database increased during the December quarter from $96b. Providers took an estimated $818 million of annual fees, with an average of 0.79%. This was up from $761m in the September quarter, when the average was also 0.79%.

Bunkall says consumers now have a wide range to choose from when it comes to fees.

ANZ led the market share (19.5%) with more than $20.3b, followed by Fisher (15.4%) with $16b. They were followed in order by ASB, Westpac’s fund manager BT and Milford.

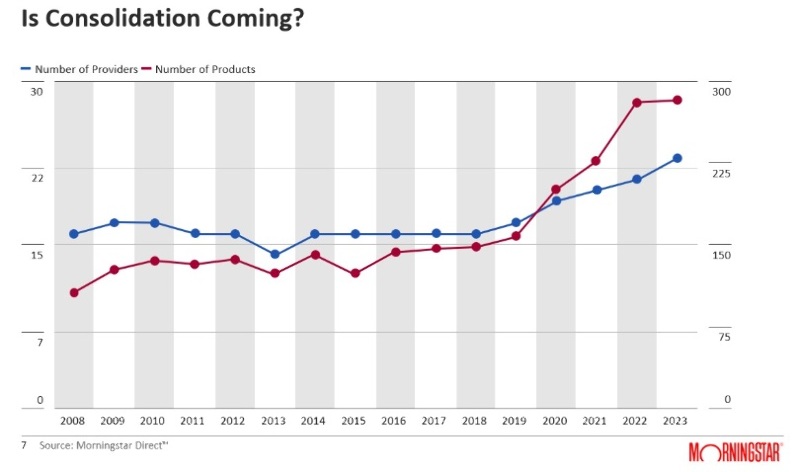

The five largest KiwiSaver providers account for approximately 68% of assets in Morningstar’s database and generated around 69% of the fees. This led the other 24 providers surveyed scrapping it out for 32% of the market, with Bunkall saying some KiwiSaver providers are sub-scale right now.

Quarter on quarter there was some minor jostling further down the ranks with ethical fund manager Pathfinder climbing from 19th to 17th place, Forsyth Barr dropping one from 18th to 19th, and InvestNow taking a backward step from 17th to 18th place. FANZ dropped one place, PIE funds climbed one place and the rest remained steady.

Sustainability

Last September Morningstar added its Global Sustainability Rating to the survey; in the growth category 20 funds received four or five globe ratings for relative environmental, social, and governance risks within their portfolios. This was up from 18 funds for the September quarter.

“Every single KiwiSaver fund these days has a sustainability policy. They have exclusions avoiding certain stocks and they have engagement policies – it's almost become table stakes in KiwiSaver and especially in the default category with some of the larger providers.”